From 11-15 August, markets will digest a string of high-impact U.S. economic releases.

July’s Consumer Price Index (CPI) lands on Tuesday, 12 August, with core inflation expected to edge up to 2.8% from 2.7%.

Thursday will bring the Producer Price Index (PPI), which will offer a closer look at input costs that could filter through to retail prices.

Finally, Friday’s retail sales data, alongside fresh readings on consumer sentiment and inflation expectations, will round out the picture of economic health in the United States.

In fact, at the time of writing, the CME FedWatch Tool highlighted an 88% probability of a September rate cut.

Whether this week’s data shifts the Fed’s position could determine if Bitcoin is primed for a new ATH in the short-term.

Leverage is back, but is it stable?

This week, Bitcoin’s Aggregated Funding Rates moved into clearly positive territory (about 0.012 on the chart). This, while the Open interest reversed its early-August decline and climbed to roughly $41.5 billion.

These two readings implied that fresh, leveraged longs may be behind the move – A clean bullish fuel that would explain the sharp price advance.

And yet, sustained positive funding might raise the cost of carrying long positions and can make gains fragile. A macro miss or a volatility spike could trigger rapid de-leveraging.

BTC eyes resistance as ETH loses ground

Here, it’s worth noting that Ethereum’s ratio against Bitcoin slipped from its recent peak near 0.037 – A sign of capital rotation towards BTC.

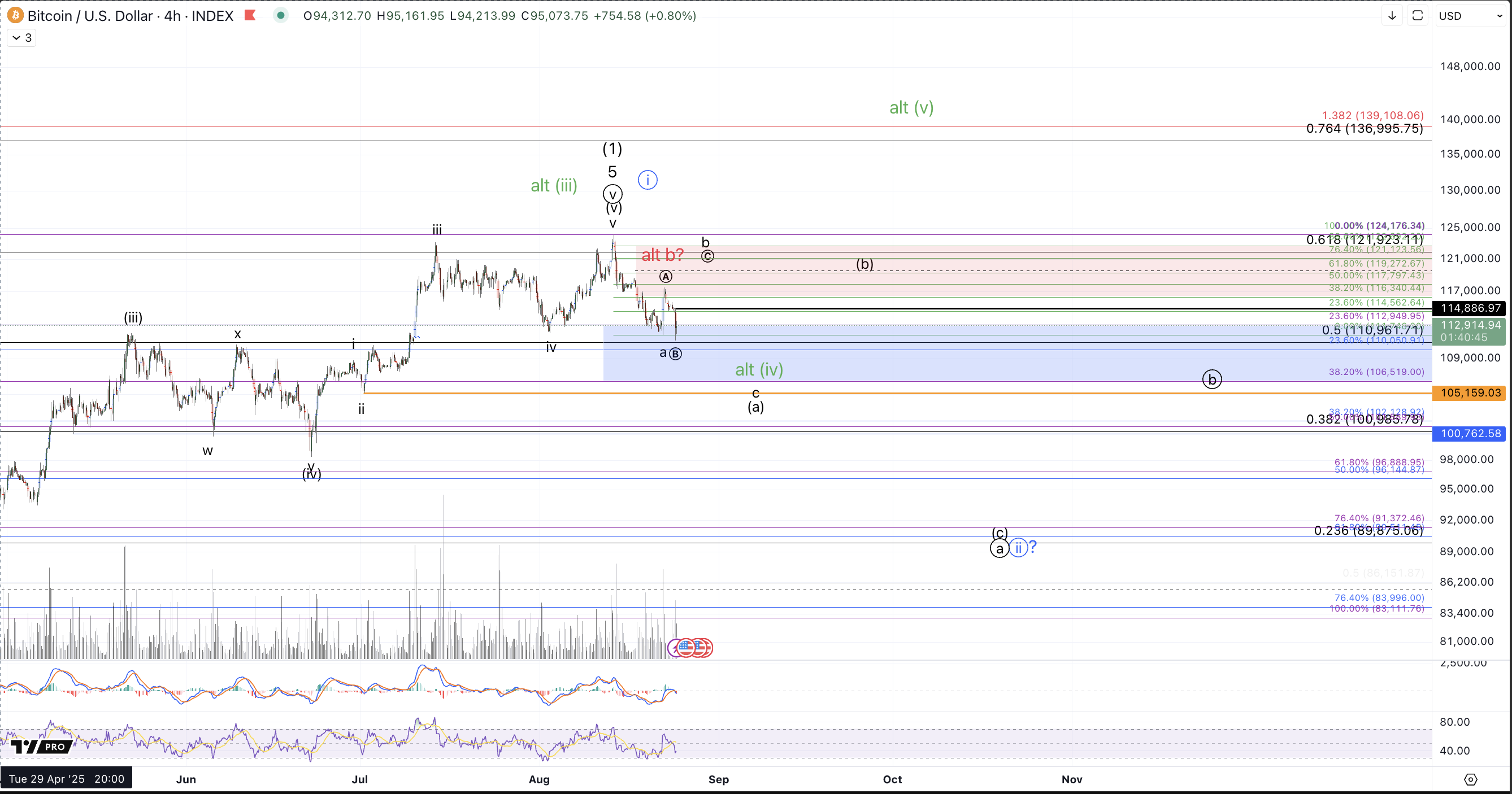

In fact, BTC/USD’s daily chart suggested that momentum was strong at press time.

The MACD formed a bullish crossover, while the RSI’s reading of nearly 66 meant that there may be some room before hitting the overbought territory. For its part, Bitcoin’s price cleared $120,000 with conviction, making the $118,000-$119,000 zone a key support if a pullback happens.

The next key test? The $123k Bitcoin ATH. A decisive breakout and sustained hold above it could trigger price discovery.

With ETH/BTC retreating, Bitcoin’s dominance may strengthen further. However, sustaining this run will hinge on macro data aligning with bullish expectations.